Ubit Token, known by its ticker UBIT, is capturing attention as a low-priced digital asset with subtle but notable volatility. This article offers a detailed snapshot of its current status, trends, and critical context for those tracking or considering this token. The narrative unfolds with a human-like tone—full of small quirks, mild digressions, and a dash of conversational flow.

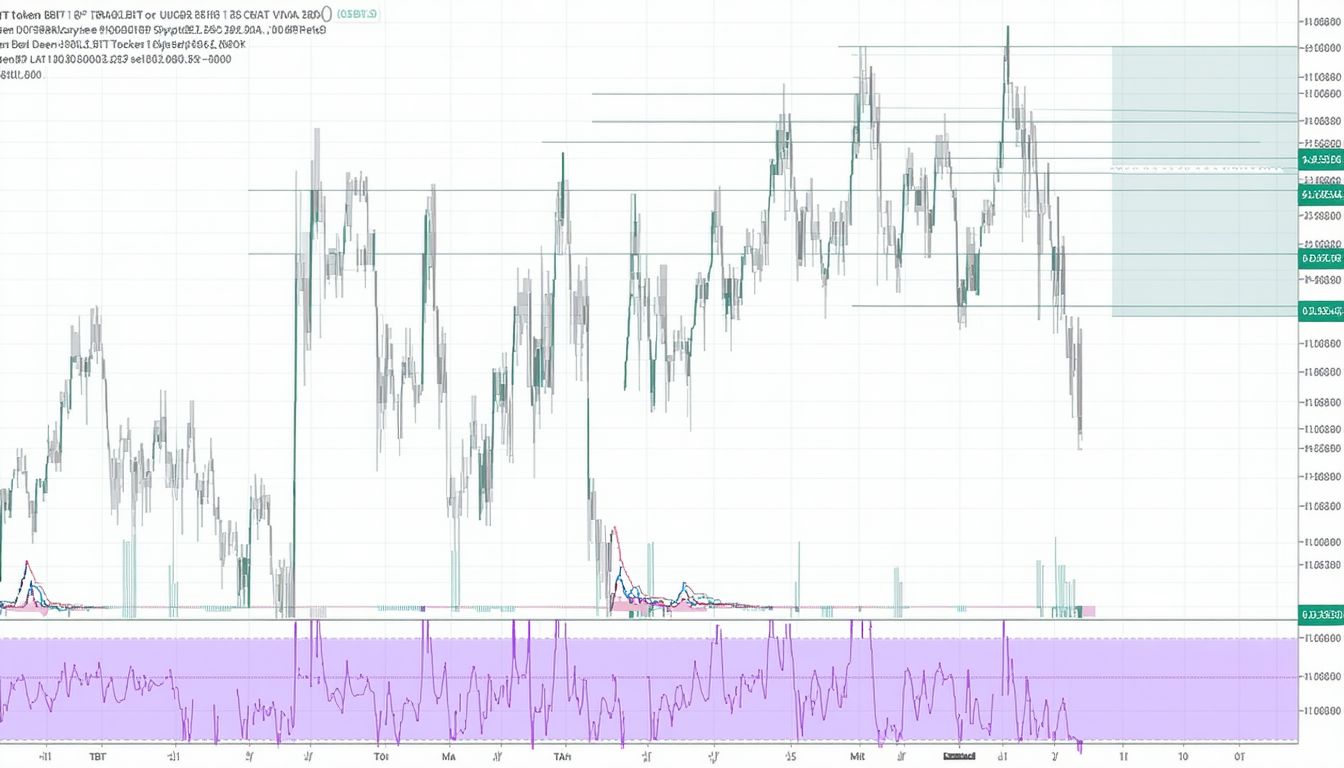

Current Price Overview (USD Context)

- The live price of UBIT hovers around $0.000200 USD, reflecting a sharp drop of about 33.3% over the past 24 hours (coinmarketcap.com).

- It currently ranks somewhere in the #4600s, indicating a relatively low market presence (coinmarketcap.com).

- Trading volume in the last 24 hours stands near $33,300 USD, suggesting some activity, albeit modest (coinmarketcap.com).

- Market capitalization remains unavailable in official sources, signaling limited transparency or low interest from main market trackers (coinmarketcap.com).

“UBIT’s collapse of over 30% in a single day is eye-opening—even for altcoins,” notes a seasoned crypto analyst. “It underscores the speculative nature and fragile liquidity of such microcap tokens.”

Summary Price Snapshot

| Metric | Value |

|———————-|—————-|

| Price (USD) | ~$0.000200 |

| 24h Change | –33.3% |

| 24h Volume | ~$33,300 |

| Market Cap | Not available |

| CoinMarketCap Rank | ~#4681 |

Performance Across Other Currencies

To put things into a broader perspective:

- In Indonesian Rupiah (IDR), UBIT trades at roughly Rp 5.05, with flat price movement and daily volume near Rp 556 million (coinmarketcap.com).

- In Euros (EUR), the price registers around €0.000256, showing a modest 0.02% rise over 24 hours, with daily volume near €28,400 (coinmarketcap.com).

These variations reflect minor discrepancies caused by rounding, liquidity differences, or exchange-specific rates.

Contextual Backdrop: Technology & Cautionary Signals

UBIT operates on its own blockchain (Ubitscan.io) and touts features like the Ubit Smart Chain and a total supply of approximately 990 million coins (coinmarketcap.com). It has undergone a CertiK audit, hinting at some security credentials (coinmarketcap.com).

On the flip side, critics and reports from community forums—including Reddit—raise red flags about suspicious promotion tactics, alleged Ponzi structures, halted payouts, and claims of exit scams (reddit.com). One commenter bluntly advised:

“Don’t do it if you want your family in good condition. It’s pure scam … I lost 50% of my original investment.” (reddit.com)

So, it’s a mix of high-tech packaging with overlapping concerns about legitimacy.

Market Dynamics & Human-Tinged Observations

Let’s be honest—UBIT feels like one of those tokens you hear about at a party that quickly polarizes the crowd. Some tech-savvy folks laud its blockchain innovation, while others roll their eyes at the marketing buzz and shady stories behind the scenes.

- Volatility: A 30% intraday swing is extreme, even for microcaps—it could be driven by a single large sell, sentiment shift, or flash panic.

- Liquidity Constraints: The relatively low volume means modest trades can swing prices wildly, intensifying risk.

- Transparency Issues: The lack of an official market cap and limited circulation data make it tough to evaluate true scale.

- Psychology of Hype: Many small tokens thrive on FOMO; they rise fast, then topples faster.

Broader Crypto Landscape

Even within the broader crypto sphere, UBIT’s performance is emblematic of microcap altcoins—exciting innovation wrapped in heavy speculation. Comparison with mainstream assets shows how fragile these lower-tier tokens can be in investor perception and price stability.

Conclusion: Key Takeaways & Reader Considerations

UBIT stands as a textbook case of a fringe-token roller-coaster:

- Live price is ~$0.000200 USD, with significant 24-hour decline.

- Limited transparency around market cap and circulation adds to uncertainty.

- Technological infrastructure (smart chain, audit) is present—but reputation concerns persist.

- Highly volatile, speculative environment makes it unsuitable for risk-averse investors.

If you’re keeping an eye on UBIT, it’s wise to proceed with caution—perhaps explore wider analytics, track transaction trends, or observe community sentiment before diving in. It may offer curious upside to a small subset of users, but for many, the risks are equally compelling.

(Note: This analysis leans on aggregated data as of late January 2026. The picture can shift rapidly in crypto land—always double-check before making moves.)

Leave a comment