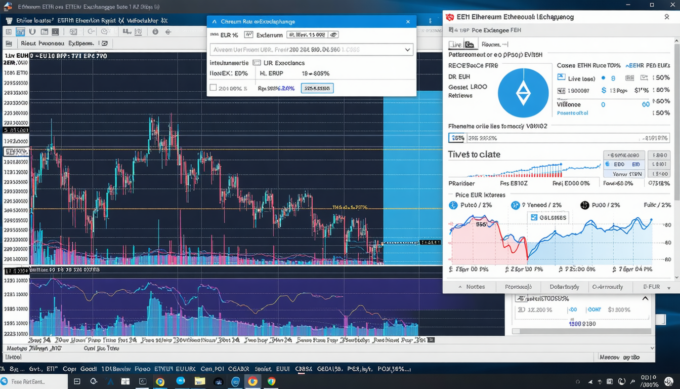

Today, Ethereum trades in the $2,880–$2,900 range, reflecting mild volatility and cautious investor sentiment. Global price trackers show ETH hovering near $2,889, with market cap around $349 billion and 24‑hour trading volume exceeding $32 billion.(coinmarketcap.com) Coinbase aligns with this, recording a price of $2,896.80, down slightly (~‑1.4%) from the previous day.(coinbase.com)

This modest pullback comes amid heightened trading activity, as Ethereum experienced a 263% surge in volume during Monday morning sessions—second only among Layer‑1 networks.(coinbase.com) Despite the dip, on-chain metrics reveal strong participation, with main exchanges showing ETH/USD quotes between $2,888–$2,890, indicating tight market pricing.(coingecko.com)

Technical Landscape & Near-Term Dynamics

Market Consolidation & Neutral Momentum

Recent technical analysis indicates Ethereum is in a consolidation phase. RSI sits just under the midpoint (~49), signaling neither overbought nor oversold conditions. Meanwhile, MACD shows early signs of bullish divergence, suggesting buyers might step in soon.(meyka.com) Bollinger Bands define a trading range roughly between $2,771 (support) and $3,246 (resistance).(meyka.com)

Intraday Shifts & Institutional Signals

On January 24, ETH/USD traded at about $2,955.74, marking a negligible decline of –0.13%.(meyka.com) Two days later, it slipped further to $2,949.36, influenced by broader market consolidation and ebbed trading volume—down significantly from average levels.(meyka.com) This pullback coincided with a positive institutional milestone: a major mortgage lender called ETH a “liquid asset,” providing a subtle but meaningful validation.(meyka.com)

Forecast Scenarios & Medium-Term Outlook

Forecast Band: Cautious Optimism & Pattern Setup

A recent technical outlook suggests ETH/USD is hovering around $3,100, forming a head‑and‑shoulders pattern. Should that structure either break bearish or reverse, the price could move down roughly 9% or climb about 12%, respectively.(tradingnews.com) The neckline rests near $5,500, a bullish target if conditions hold—advancing up to $10,000 remains plausible in a full bull cycle, though layered with resistance zones near $3,500 and $4,000.(tradingnews.com)

Institutional & Strategic Forecasts

Institutional players present varied year-end targets. Standard Chartered forecasts ETH could reach $7,500 by year-end, backed by growing institutional demand, regulatory progress, and network maturity.(exchangerates.org.uk) Other analysts range from $4,500 to $6,400 (Citi), as well as up to $5,000+ (Finder). More bullish estimates even envision $8,100–$9,800, largely driven by ETF inflows and enhanced staking dynamics.(investinghaven.com)

Technical Upgrade Catalysts: The Fusaka Effect

Looking beyond price, Ethereum’s scaling trajectory is turning heads. The Fusaka upgrade, which rolled out in December 2025, introduces PeerDAS—a method that allows nodes to sample data rather than process entire blocks. That innovation can potentially expand data capacity eightfold and cut rollup expenses by over 70%.(tradingnews.com) Combined with gas fee reductions (from ~38 gwei to possibly under 15 gwei), such improvements could dramatically boost Ethereum’s transactional appeal and competitiveness.(tradingnews.com)

Narrative Perspective: Why “Ethereum Kurs Dollar” Matters

Tracking the ETH/USD exchange rate is more than price watching—it’s insight into capital flows, network health, and technological evolution. Each price point reflects layers of investor expectation, on-chain activity, and systemic upgrades. For example, the mortgage lender’s recognition of ETH as a liquid asset hints at deepening financial integration—even as technical indicators suggest caution ahead of possible volatility.

In practice, this means every investor, developer, and policymaker glances at “Ethereum Kurs Dollar” with a slightly different lens—some see opportunities, others risk. The recent surge in trading volume, paired with neutral chart signals, illustrates that we’re watching a potential pivot. Meanwhile, the Fusaka upgrade underscores why Ethereum continues to matter strategically beyond mere valuation.

Expert Insight

“Ethereum’s price continues to mirror the network’s fundamental strength—and with upgrades like Fusaka scaling throughput while cutting costs, queued momentum may resurface soon, even amid short‑term consolidation.”

This encapsulates the cautious yet optimistic view: technical softness doesn’t erase the broader narrative of growth and institutional maturation.

Conclusion: Key Takeaways & Strategic Outlook

Ethereum is trading near $2,890, reflecting a short-term pullback but with signs of stabilization. Technical indicators point to balanced momentum, constrained within a well-defined range. Institutional forecasts paint a potentially bullish medium-term picture, with a subset projecting $7,500+ year‑end targets, contingent on sustained ETF inflows and staking momentum.

Crucially, Ethereum’s infrastructure—bolstered by the Fusaka upgrade—is a bedrock underpinning this price discourse. Whether one is focused on trading ranges (like $2,770–$3,246), chart patterns targeting $5,500, or long-term fundamental growth, the ETH/USD exchange rate remains a central metric in gauging Ethereum’s evolving story.

Leave a comment